By Randy Smith, Mobile Wallet Media

Thursday, August 30th, 2012

Daily Deals are indeed not dead, but must evolve and transform if they are to survive the mass adoption of the Mobile Wallet. Daily Deals as we know them will continue to exist, but they will need to reduce fees and discounts drastically to reach their 'Manifest Destiny.'

So just a couple weeks back I wrote about how Daily Deals are perhaps too dysfunctional to survive. I wrote the article in response to the slew of bad earnings and news reports about Daily Deals companies. This is the first article in our 'SuperCommerce Series.' Tighten your belt it's going to be a wild ride!

Daily Deal companies will need to change their revenue, distribution and redemption model to survive the coming 'Mobile Wallet Revolution.' In my previous article on Daily Deals, I spoke much about Daily Deals limiting their market with high fees and discounts. I'll add a bit to that here and now.

If Daily Deal merchant fees are reduced drastically and allow merchants to set lessor discounts or rewards, more like LevelUp, they will have a chance to provide deal vouchers for just about anything. That's right, I said anything! So yes, it will be possible for "One to Live On Daily Deals Alone!"

Well, perhaps not anything, as we know money can't buy many things.

I see this as a new "Mega Trend," one that will completely transform not just mobile commerce, but all retail commerce! This trend itself could be every bit as disruptive as mobile, the web and the mobile wallet itself. The implications of this transformation will alter all retail marketing and advertising! If you think hard about this, you will realize the spending and purchase decisions of consumers will be altered once Daily Deals are in the Mobile Wallet. With the consumer armed to carry as many deals as they want, this will prompt the consumer to buy more deals as they are easier to manage than the current, 'Clunky.' and non-seamless, redemption methods. Therefore, if the purchase cycle is moved forward to "Lock-in customers and future sales," then marketing and advertising will need to redraw their lines around this.

So is what I'm saying here that Daily Deals will become like a new virtual currency? Yes! If this new breed of Daily Deals is convenient enough and enough brand name retailers adopt this model, consumers should scoop them up like crazy. So rather than a high-discount and costly coupon or voucher to drive consumers to the store, a deal with a lessor discount, say a $110 voucher for $100 in cash. LevelUP has already shown us a glimpse of this type of offer. Convenience is traded for larger discount. Consumers will take a "Good Deal," and so may merchants, if it is easy to obtain and redeem. This model I believe will be a powerful force to direct, not just traffic, but lock in loyal customers and sales in advance. If one goes down the rabbit hole deeper, if a consumer has spent their funds on "Mobilized Daily Deals," then the decision to where they shop is done.

These types of deals have long been available during the holiday season via bonus gift card offers and consumers may purchase gift cards online at a discounted rate. But the inconvenience of carrying multiple cards has made it impractical at scale. With the Mobile Wallet, such barriers are removed.

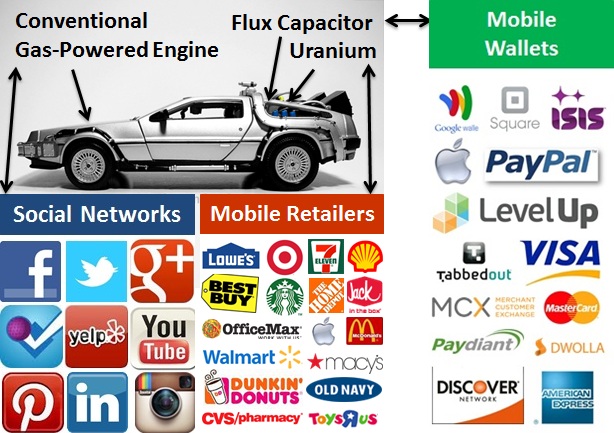

OK, now onto distribution. If you are a Daily Deal company, you are ripe for disruption if you are not plugged into and integrated with the major Mobile Wallets. Why? Because the convenience associated with receiving and redeeming offers via the Mobile Wallet will demand it.

Imagine if redeeming a Daily Deal was just like making a purchase using the Starbucks Card Mobile or LevelUp app. This is the future of Daily Deals and really offers period. Mobile Wallets will make getting great deals easy, simple, convenient and fast! Deal companies, merchants and marketers should get on board this "train of thought" or be left behind with a worthless ticket to nowhere.

So with, Google, PayPal, ISIS, MCX, Square, LevelUp and more Mobile Wallets launching this Fall or 2013, don't you think they might be interested in offering a high-margin, Daily Deal service of their own? Well, one may say it may be easier to just partner with Groupon or Living Social or another of the myriad of the high-volume, Daily Deal companies. On the other hand, with the stock hit Groupon has taken as of late, perhaps they are ripe targets for acquisition by Mobile Wallet companies. Via acquisition they may lock in merchant relationships, a sales force, a platform and revenues, all in one fell swoop. Or perhaps Daily Deal platform infrastructure companies will be ripe acquisition targets? Mobile Wallet companies are all armed with a massive customer base and billions of bucks. Buying infrastructure alone could make for an exellent investment. Of course some of these companies may already own a Daily Deal platform.

Amazon, which has a large investment in Living Social, may stand the best chance to stand firm and negotiate deals with all major wallet players. Amazon, has yet to make a move or tip it's hat with regards to it's plans for a Mobile Wallet, even though they are very adept at processing payments.

Apple, with it's much anticipated launch of it's iphone 5, with or without NFC and possible announcement that Passbook will become a complete mobile wallet, is news we are all eagerly waiting to hear.

First Data launched a new service named "OfferWise" at SXSW this past Spring. To quote First Data from their YouTube page "First Data's OfferWise solution is a revolutionary product that allows consumers to electronically link offers and deals to any payment card or mobile wallet." The release by First Data in June, is titled "First Data OfferWise Solution Enables Universal Commerce for Offer Publishers and Merchants." First Data, if you are not aware, processes an estimated 60-65% of all retail transactions. If OfferWise can be a "platform in the cloud that seamlessly ties offers to Mobile Wallet," they could prove to be a platform of choice for Mobile Wallets and one not to ignore.

Daily Deals in the Mobile Wallet, for clarity's sake, will not actually be a "gift or prepaid card," but will be a voucher, that may be redeemed via one's Mobile wallet, at a specific set of retailers, for a limited time. The other side of the equation to enable Daily Deal to be processed has to do with the integration to Point of Sale (POS), which I've touched upon in recent articles, and hence will not belabor again now.

How Mobile Wallets, Daily Deals, POS vendors and processors all decide to work together to build the future of Daily Deals and mobile commerce will be interesting to watch, but rest assured and God-willing, I will be here to comment upon it or be part of building it.

To wrap it up, and set up my 'Shameless Plug of the Day,' as a brand new journalist and as a FIRST-TIME EXPECTING DAD, I'll leave some meat on the bone for a later discussions and paid consulting. Just remember to tell others you heard it here first, refer others to read my articles and hire me to consult. I'm also open to offers I cannot refuse.

Mobile Wallet Media is a news media, analyst, marketing and consulting firm focused on the future of mobile: payments, commerce, daily deals, security, loyalty, marketing, prepaid cards, virtual currency and the convergence of them all with social and local. Randy Smith, the Founder and Chief Editor of Mobile Wallet Media, was also the primary founder, inventor and former CEO of MobilePayUSA, a TechCrunch Disrupt Startup Alley Winner in 2010.